Warm weather is coming, which means it is time to start on Spring cleaning! Here are our top priorities when we start prepping our homes for the hot months:

Q&A with Lender Charlie Fleming

Charlie Fleming, President, Remarkable Mortgage

1) What would you tell buyers who are waiting to buy due to rising interest rates? Those who are waiting for rates to go down, are actually waiting for home prices to go up. We are seeing normalized market conditions, where buyers are obtaining longer contingency periods, longer days of due diligence, seller paid closing costs, and in certain instances, sale contingencies on a home that they are telling to sell.

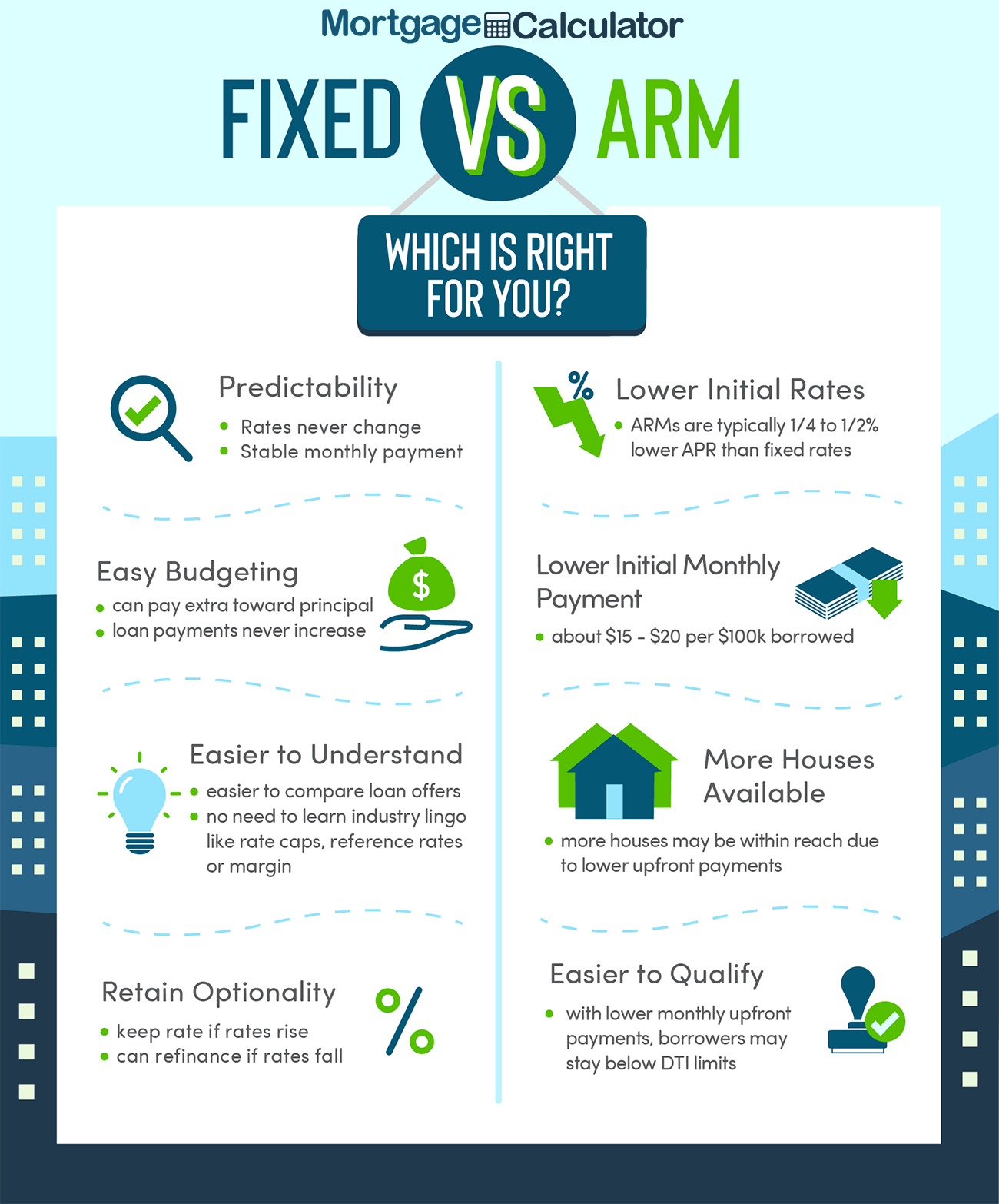

2) Can you explain the difference between an ARM and Fixed loans? An ARM is an adjustable rate mortgage, where the interest rate is fixed for a certain amount of time, and then adjusts based on a financial metric such as a LIBOR, where a fixed loan is fixed for the entire duration of the mortgage

3) What do you predict for the housing market in the upcoming year? It’s hard make predictions, especially about the future. I would say we will continue to see rates around the mid 5’s, inflation to remain under control through harsh federal reserve actions, and a healthy spring and summer market. I don’t think we will ever see the 2020 and 2021 numbers, but we should anticipate a year similar to what we saw in 2016, 2017 and 2018.

4) If you could go back in time and give yourself one piece of advice before buying your first home, what would it be? Have more money saved up for emergencies. I moved in my first house and had some problems with my house. Common repairs and stuff the inspector DID mention, but I delayed it. I always advise my clients to have some sort of emergency fund saved up, and tell my story!

5) Can you tell us a little about how down payment percentages change based on loan types? The top 3 most popular loan programs out there currently are Conventional, FHA, and VA. Conventional loans offer 3% down to qualified buyers, but most like to strive to come up with 5% because you obtain cheaper Private Mortgage Insurance with the 5% down option. That said, 3% down can sometimes be a LOWER rate than 5% down on conventional! FHA has a minimum requirement of 3.5% down. FHA is typically used for individuals with lower credit scores (580-700). FHA is still a popular and strong product for many. The VA loan, in my opinion, is the safest and most secure loan on the market. When it comes to home financing, the VA gets it right on this and offers a strong product for eligible Veterans. A VA loan offers 100% financing for qualified Veterans.

6) What criteria are lenders looking at when pre-qualifying buyers for a loan? Two big things: credit score and debt to income ratio. These feed into each other and give lenders a great framework to work on: will the buyer have the ability to repay the loan, is their income stable, and can they handle this new debt we are giving them?

About Charlie:

Charlie Fleming | President | Loan Officer | NMLS #1201695, Remarkable Mortgage NMLS #491039 | (404) 213-2447

Mortgage lending goes beyond simply selling a loan to a borrower. It’s about connecting the borrower to their future home. To me, nothing is more rewarding than watching a client become a homeowner knowing that I was part of the process.

My industry experience has taught me to take the time to understand my clients: What’s their story? How can I help them in their pursuit of a home? When I see my clients as real people with real goals, needs, and dreams, I get to create a lending experience that redefines the standard.

All clients have a story to tell. What they need is a lender who can personalize a loan to meet their wants and needs. My job is to make the complicated process of obtaining a home loan simpler. At Remarkable Mortgage, we achieve this by modernizing mortgage lending. As your Loan Officer, I promise to connect you to your future home and facilitate a quality lending experience of exceptional value.

Courtesy of Remarkable Mortgage

The 2022 Market is Not the Same as 2008. Here's why...

When you hear people talk about today’s shifting housing market, they often compare it to the housing crisis in 2008. While there are some comparisons that can be made, what we are experiencing now is a lot different than 15 years ago. In order to dissolve this line of thought, let’s focus on some key variables from then and now.

In 2008, job cuts (net of gains and losses) reached up to 8 million. Present day, job cuts (net of gains and losses) are practically none. There are 20 million more jobs available now than there were in 2008. Subprime loans were also very prevalent in 2008, whereas now they are virtually non-existent. The amount of new construction homes inflating the market in 2008 reached up 7.65 million compared to today’s 4.6 million. Similarly, the inventory in 2008 was as high as 4 million, whereas the inventory now sits between 1-1.2 million. Additionally, mortgage delinquency in 2008 reached 10% while today’s is around 3.6%. Foreclosures in 2008 were up almost 5% compared to .6% in 2022.

What does this mean? We do not have the same market conditions to mimic the housing crisis in 2008. As we see inventory rising and competition lowering, you can expect to see the housing market returning to some sense of normalcy.

Determining the Differences Between Wants vs. Needs in the Home Buying Process

It’s easy for homebuyers (and especially first time homebuyers) to start their home search wearing rose colored glasses. We get excited by the prospect of home-ownership, and think most about how we will arrange and inhabit our space rather than what home makes the most sense for our lifestyles and budgets. As always, the first step for a homebuyer is pre-approval. Once you know what you qualify for, it is so important to make some lists based on your budget. The best way to do that?

Think about the following categories: your must-haves, meaning your non-negotiable items, your nice-to-haves, or the things you want but could live without, and lastly, your dream features.

Making these lists will not only help keep you focused when looking at homes, but it will also help you make decisions more efficiently and thoughtfully.

So, for example, a non-negotiable or must-have item could be a good foundation, spacious kitchen, or a sufficient number of beds and baths. Some examples of nice-to-haves might be hardwood flooring throughout, a pool, finished basement, or a fenced in backyard. And the dream items? This is where you get to go wild. On this list, you might add things such as a pot filler in the kitchen, a wet bar, outdoor entertainment space, or a steam unit in the shower. Of course, the items on these lists will vary dramatically based on the individual and their budget. But what remains the same regardless is that if you want to see a home that does not check off items on your must-haves list, you probably shouldn’t be looking at it. Once you have made your lists, present them to a trusted realtor! Based on your lists, they can tailor to best suit you. This allows your realtor to optimize their showing time, so you can see a number of houses without wasting time on the ones that are not for you.

Best Renovations for the Highest Return on Investments

When renovating your home to improve it’s value, it is important to understand what renovations will add the most value to your home. A good rule to follow is to put the majority of effort and money into the spaces that are the most occupied in a home. For example, the kitchen! This is a room that will be used to some degree every single day, so improvements made to this area will yield a higher return when it comes time to sell. Another remodel to consider are the bathrooms. Because the kitchen and bathrooms are generally the most expensive to renovate, they also provide the largest increase in home equity. When a home’s kitchen and bathrooms are updated and well-maintained, a buyer will be much more inclined to put in the work themselves to improve other areas of the house (i.e. bedrooms, living room, etc).

Another renovation to consider, though it may not be as fun as a kitchen remodel, are the floors. Refinishing or replacing hardwood floors can lead to a ROI between 118-147%. As we move toward making homes more energy efficient, it is important to consider the value energy-related renovations can bring. Consider upgrading insulation, replacing windows, or converting the attic/basement to a live-able area.

The Holiday Season in Athens, GA

Every December, the sweet town of Athens transforms into a Christmas town that rivals those in most Hallmark movies. Downtown is lined with lights, the Christmas tree is decorated and displayed by city hall, and the local businesses are all bustling with shoppers. Here are some fantastic events coming up in Athens, GA this holiday season that you won’t want to miss:

The third annual Beechwood Holiday Market will open on Friday, Nov. 25 at 6 p.m. with a Christmas tree lighting and a holiday concert by Atlanta-based band, The Big Beyond.

Opening night will include a giveaway sponsored by some of Beechwood’s brands, including Kendra Scott, Lululemon, Foot Palace, Your Pie, Crunch Fitness, and more. In addition to live music, visitors will enjoy food trucks, Santa photos, hayrides, face painting, s’mores, and hot chocolate.

For additional information, visit: beechwoodathens.com/holiday-market-2022/. To sign up for Holiday Market updates, text “Beechwood' to (833) 946-1799.

It's time to lace up your boots and grab your favorite sweater because Athens on Ice public ice skating season is here!

Grab your ticket now to get ready for the season. The rink will be indoors from November 24 - January 8 and will move outdoors to the 440 Foundry Pavilion from January 27 - March 1. Skate sessions are 90 minutes of fun at only $13 per ticket. Groups of ten or more are eligible for $10 tickets. Want to skate regularly all season? Then grab a season pass for just $100 that will last from November through February! All tickets include skate rental (and smiles) for the session.

Now in its second year, the State Botanical Garden of Georgia at UGA is transforming this holiday season into a glittering winter wonderland of lights. The walk-through light show extravaganza features 11 illuminated displays along a half-mile path that is certain to delight and inspire. Meander with your family and friends and create magical memories among twinkling displays, colorful decorations and a mesmerizing multi-colored light tunnel. The Winter WonderLights show will include a Garden of Delights, Candy Cane Lane and Cone Tree Plaza, among other magical features.

Lighted displays will delight children and adults most evenings from Nov. 23, 2022, through January 8, 2023. The Alice Hand Callaway Visitor Center will be transformed into a holiday market, where guests can shop for gifts and souvenirs. Refreshments such as cookies, s’mores, bottled water, hot chocolate and coffee will be available throughout the light show.

The half-mile trail will take from 45-60 minutes to complete and is fully ADA accessible. Tickets are $15 each, free for children under age 3, and must be purchased online in advance. Winter WonderLights is presented by the University of Georgia.

Let's Talk Price Reductions

If you haven’t been living under a rock, you may have heard that interest rates are rising, causing the market to slow down significantly compared to recent years. In addition to rising rates, we are also moving into winter months, which historically yield lower property transaction numbers. All of this can be a little disheartening for sellers, especially since this time a year ago they were experiencing multiple offers, many of which were over asking price. It is important to remember that there is a reason for rising interest rates: to bring down inflation. And inflation has grown astronomically recently, so our interest rates have, too. Rather than focusing on what you could’ve gotten for your home in 2021, or thinking that value is equivalent to your home value now, consider reframing your mindset. When listing a home, you want to have an understanding of the market so you can determine a competitive listing price. Although it seems daunting to sellers, price reductions are becoming more and more common, and if you base your list price and reductions on a firm understanding of the market, you can be sure that you will get the most equity out of your home sale.

So, when do you reduce your listing price and by how much? When listing your home, start a little high ( a little meaning anywhere between $5,000-$10,000 over market value). If there is a cash buyer to meet this demand, then great! If not, then your first reduction will be about getting a little closer to market value. Move the price down in small increments, somewhere between $2,000-$5,000 at a time. A good rule of thumb would be to reevaluate the buyer activity you’ve seen around your listing every 2 weeks or so. Are you getting a lot of showings or none at all? If the former, drop it by $2,000. If the latter, drop it by $5,000, maybe. The buyers behavior will tell you what they think of the price. You just have to listen!

There is no hard and fast rule for price reductions on homes, but with the right realtor as a guide, you will still earn the equity you wanted from your home sale.

What is an adjustable rate mortgage? Let's talk about it.

An adjustable rate mortgage, often referred to as an ARM, is a type of home loan with an interest rate that fluctuates with the market. This is in perfect contrast to the fixed-rate mortgage, which has the same interest rate for the life of the loan, meaning your monthly payments stay the same.

Prospective home buyers have the choice between an adjustable rate and a fixed rate mortgage, so it is important to understand their differences. An ARM home loan has two periods: the fixed period and the adjustment period. The fixed period is at the beginning of the loan’s life (generally the first 5-10 years) and during this time your interest rate will not change. The adjustment period is when your interest rate may fluctuate depending on the market. It is important to note that with an ARM in the fixed period, you will likely have a lower rate initially. The concern many have with this type of loan is that if interest rates spike during the adjustable period, so does your rate. The reverse is also true, meaning if interest rates fall dramatically, so does your rate.

As we see rising interest rates going into 2023, you may consider asking a lender about the option of doing an ARM loan. You will be given a smaller initial interest rate during your fixed period with the hope that once you reach the adjustable period, inflation and interest rates will go down, making your monthly payments smaller. It’s also important to remember that you can always refinance!

NOTE: Always ask your lender any pertinent questions about loans! Whereas realtors are very market savvy, the lenders specialize in mortgages and interest rates. So, ask an expert before you make your decision.

Winter 2022 Market Update

Here’s what is happening in the Georgia real estate market right now…

As we move into colder months, a lot of people are curious about the rising interest rates and whether or not now is the time to buy or sell. Here are some market statistics to keep in mind when considering buying or selling a home right now:

First of all, why are interest rates going up? Interest rates are raised in an effort to curb rapid inflation and rising home prices. Higher rates slow people from borrowing money and therefore spending that money, which encourages prices to lower.

There is a growing gap between a property’s original listing price and what it actually sells for. Price reductions are becoming more and more common as seller’s set their minds on high prices that were realistic months back, but are no longer within reach for most buyers due to higher interest rates.

The median sold price in single family homes has been just under $300,000 for the last three months.

It is important to remember that interest rates always fluctuate, and you can still grow your equity in this market. How, you ask? Talk to a realtor!

Grace Williamson

REALTOR

404-825-0422

Our Top 3 Tips For Tenants!

Is it your first time renting? Well, no worries, we’ve compiled a list of some of the largest issues (and there accompanying solutions) when dealing with tenants, to help you become a great tenant!

1. Pay Your Rent On Time

Nothing can make property managers happier than tenants that pay their rent on time. Missing payments may have an affect on your credit score, so not missing a payment is very important. Financial hardship can always come out of nowhere, so if you’re unable to make rent, make sure to let your landlord/property manager know as soon as possible.

2. Treat Your Rental Like You Own It

Taking great care of your rental lays down a good groundwork for good relations with your property manager. It also ensures that you’ll get your deposit back when it’s time to move out. Normal “wear n’ tear” is to be expected, but damage (i.e. spilling red wine on the carpet, a candle lighting something on fire, etc.). Most damage occurs in singular incidents rather than gradual degradation (i.e. discoloration in carpet form foot traffic, etc.)

3. Let Your Landlord Know About Maintenance Problems ASAP

Of course, we hate to get bad news about properties, who wouldn’t? But they’re budgeted for, they’re expected when owning real estate. Many problems can become more severe if left un-repaired (i.e. roof leaks seeping into dry wall, then carpet, creating a mold issue). It is part of the tenant/landlord relationship that tenants are usually the bearer of bad news. So just let your landlord/property manager know as soon as you know.

Source via: Money Crashers

4 Real Estate Tips To Sell Your First Home

It can be difficult to sell your first home, it is called your “home”. You may have built your life there and can’t bear to see it end. But, here at OurTown, we’d like to supply the necessary information for any seller when selling their first home.

1. Make sure you’re ready to let go

Selling your first home can come with a lot of emotional baggage, and overall isn’t easy. You’ve likely spent a lot of time here and may not think you’re ready for such a drastic change. But these anxieties and apprehensions are normal and a part of the process when selling your home. It can be easy to think you’re not ready when you just need that push to convince you to sell your home.

2. Focus on Curb Appeal

The quality of the inside of your home is a given when selling your home, but what 76% of real estate agents agree on is the public appeal boost that curb appeal supplies. Curb appeal is the area in front of your home, and such upkeep is important when selling your home. Forms of curb appeal improvement include:

Basic Yard Care Service

Scatter Fresh Mulch

Fresh Coating of Paint on Front Door

While this improvements do not to much for the appraisal of your home, they can interest buyers before they’ve ever seen the inside.

3. Get ahead of repair requests with a prelisting inspection

We, at OurTown, reccomend that you buy a home inspection before they list their house, to ensure that they can get ahead on any repair requests. Long repair lists can turn off a lot of buyers and even give them more power when negotiating prices. It’s important to maintain your house during this period to ensure getting as close to your asking price as possible.

4. Treat your agent as a partner, not an employee

When dealing with your agent, such as our wonderful agents here at OurTown, it is important to not go in with a “my way or the highway attitude”, it is a partnership, an agreement to each other to help sell this home. Remember that your agent chooses you, just as much as you choose the agent. You shouldn’t take a passive approach either, it is important to communicate with your agent. Make it a point to contact a least once a week to hear about buyer feedback, market updates, and response rates on ads that you may be running.

Selling your home can seem overwhelming and scary at first. But at OurTown, we don’t believe it should be, and we will do everything in our power to assist when you’re selling your home too!

Source: Homelight

Winter Housekeeping Tips

With the winter season finally starting up, we at OurTown, would like to offer some tips for the upcoming season.

Clean Your HVAC

In months that you’ll be using the HVAC the most, it is most advised to replace your filters ASAP to keep the air ducts and vents cleared. This keeps air clean in a time when you’ll be having a lot of guests over.

Deep Clean Your Kitchen

Since you’ll already be tidying up for incoming guests, it’s convenient to go ahead and clear out those kitchen drawers with anything you don’t need or use anymore. This will reduce clutter and clear room for any gifts you may receive.

Wash Those Windows

Windows can be a big part of any rooms and keeping them clean is essential. If you don’t clean windows, you can always hire professionals to get it done for you!

5 Must-Know Packing Tips

Moving homes is an exciting, yet often overwhelming process. With that comes packing up your entire home, which can be stressful, but it doesn’t have to be! Having a plan and preparing for the move well in advance can save you time and relieve some of the stress that comes with last-minute packing. Check out these 5 steps to simplify your next big move!